Create Your First Project

Start adding your projects to your portfolio. Click on "Manage Projects" to get started

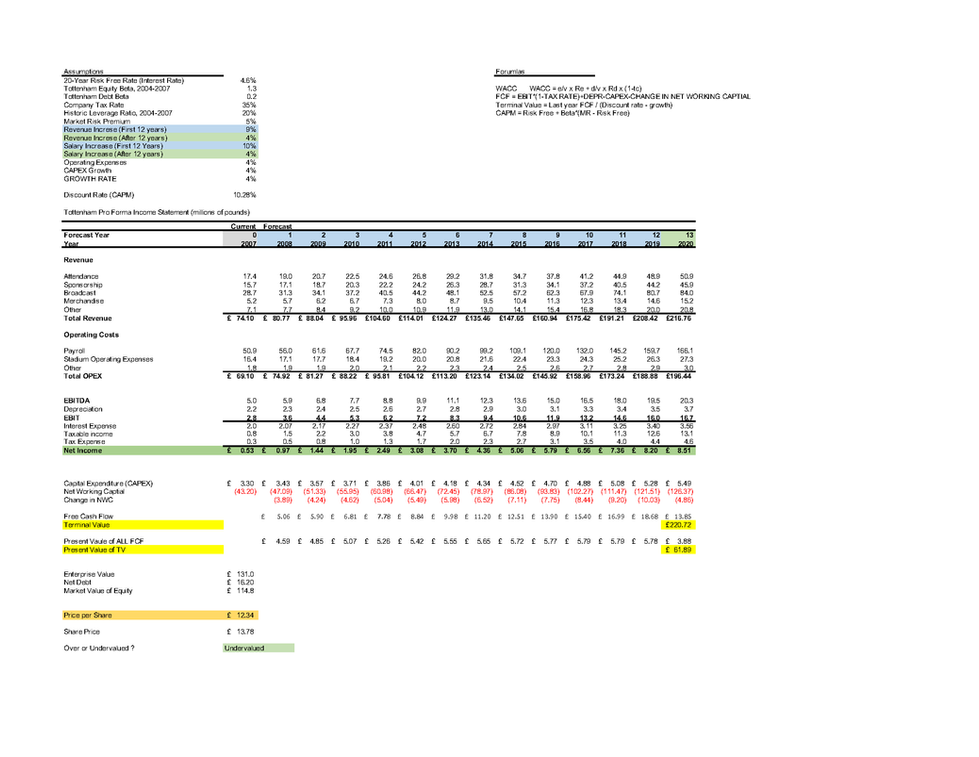

Case Study: Tottenham Hotspur Plc: Capital Budgeting & Valuation Analysis

Date

Spring 2025

Location

Fort Lauderdale

Role

Served as the Financial Analyst, responsible for performing the capital budgeting calculations, interpreting financial outcomes, and presenting recommendations. I evaluated projected revenues, depreciation, and cost structures across all scenarios, applying NPV, IRR, and equity value modeling to determine the most profitable strategic path for the club.

This project analyzes Tottenham Hotspur Football Club’s strategic investment options using advanced capital budgeting and valuation techniques. The analysis evaluates four key scenarios impacting the club’s market value and shareholder wealth:

1️⃣ Fair Value Analysis – establishes baseline valuation using equity and enterprise value metrics.

2️⃣ New Stadium Construction – assesses the financial impact of a £250M, 60,000-seat stadium project.

3️⃣ High-Profile Player Acquisition – evaluates ROI and market performance from a £20M player investment.

4️⃣ Combined Stadium + Player Investment – integrates both strategies for a comprehensive financial forecast.

Using NPV, IRR, enterprise value (EV), and share price modeling, this study identifies how strategic capital allocation affects both operational performance and market valuation.